Gold365 Review: Seamless Digital Gold Investment Platform and Its Synergy with 11xplay pro

In an era where digital finance reshapes traditional asset classes, Gold365 emerges as a pioneering platform for buying, selling, and storing digital gold. Leveraging blockchain technology and robust regulatory compliance, the service caters to both seasoned investors and newcomers seeking a hassle‑free entry into the gold market. This article examines the platform’s core functionalities, security protocols, user experience, and its strategic alignment with complementary services such as 11xplay pro, which together create a more comprehensive financial ecosystem.

What Sets Gold365 Apart?

Gold365 differentiates itself through three primary dimensions:

- Real‑time Gold Pricing: The platform integrates live market rates from reputable exchanges, ensuring that transactions reflect the most current price of gold.

- Instant Settlement: Users can complete purchases or sales within seconds, eliminating the latency typical of traditional gold trading.

- Physical Backing: Every digital gram is fully backed by audited physical gold stored in secured vaults, providing a tangible safety net.

Key Features of the Platform

1. User‑Centric Dashboard

The intuitive dashboard presents a clear overview of holdings, transaction history, and market trends. Customizable widgets allow investors to monitor price alerts, portfolio performance, and upcoming promotions—all in a single view.

2. Multi‑Device Access

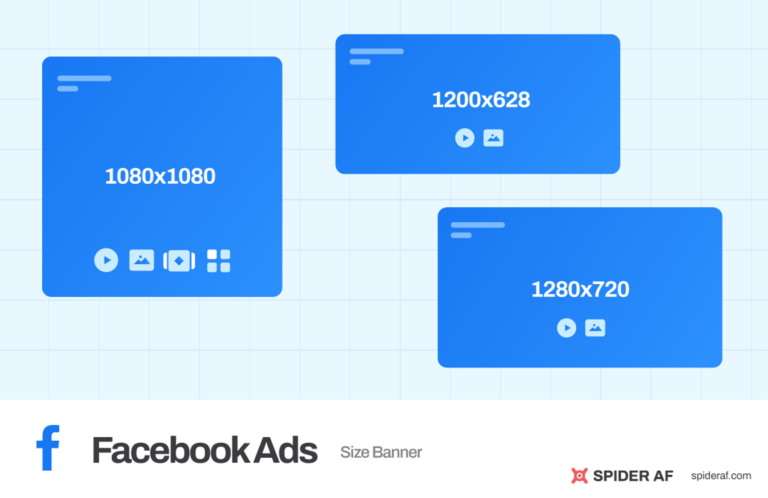

Whether on a desktop, tablet, or smartphone, Gold365 ensures consistent performance. Its responsive design adapts to varying screen sizes, and the dedicated mobile app offers offline notifications for price spikes or market news.

3. Diverse Transaction Options

Investors can choose from multiple purchase sizes, ranging from 0.01 gram to larger quantities, accommodating both micro‑investors and high‑net‑worth individuals. The platform also supports scheduled purchases, enabling dollar‑cost averaging without manual intervention.

4. Secure Storage & Insurance

Physical gold is stored in high‑security vaults located in financially stable jurisdictions. Independent third‑party auditors conduct regular reconciliations, and the assets are fully insured against theft, loss, or natural disasters.

5. Compliance & Transparency

Gold365 complies with local financial regulations, including KYC (Know Your Customer) and AML (Anti‑Money Laundering) standards. Transaction logs are immutable, thanks to blockchain integration, granting users verifiable proof of ownership at any time.

Why Digital Gold Matters Today

Gold has historically served as a hedge against inflation and geopolitical uncertainty. By digitizing gold, platforms like Gold365 democratize access, allowing investors to hold fractional amounts without the logistical challenges of physical storage, transportation, or purity verification. Moreover, the agility of digital transactions aligns with modern investment strategies that demand speed and flexibility.

Integrating with 11xplay pro: A Strategic Synergy

While Gold365 focuses exclusively on gold, many investors seek diversified portfolios that include equities, commodities, and derivatives. 11xplay pro offers a comprehensive suite of trading tools for stocks, futures, and other asset classes. When used in tandem, the two platforms enable a balanced approach:

- Portfolio Diversification: Users can allocate a portion of funds to digital gold via Gold365 while actively trading equities on 11xplay pro.

- Risk Management: Gold’s traditional safe‑haven properties complement the higher volatility of equities, creating a natural hedge.

- Unified Reporting: Both platforms provide exportable CSV statements, allowing investors to consolidate data into a single financial tracking system.

Security Measures: Protecting Investor Assets

Security is paramount in digital finance. Gold365 employs a multi‑layered approach:

- Two‑Factor Authentication (2FA): Every login requires a secondary verification code, reducing the risk of unauthorized access.

- Cold Storage for Private Keys: Cryptographic keys governing gold ownership are stored offline, insulated from internet threats.

- Regular Penetration Testing: Independent security firms conduct quarterly assessments, identifying and remedying vulnerabilities before they can be exploited.

Customer Support and Community Engagement

Responsive customer service distinguishes reputable platforms. Gold365 offers 24/7 live chat, email support, and a comprehensive knowledge base covering FAQs, transaction guides, and compliance queries. Additionally, the platform hosts webinars and community forums where users can discuss market outlooks, share strategies, and receive insights from industry experts.

Potential Challenges and Considerations

Despite its advantages, prospective users should be aware of certain nuances:

- Regulatory Landscape: As digital asset regulations evolve, compliance requirements may change, potentially affecting transaction fees or account verification processes.

- Liquidity Timing: Although settlement is near‑instant, large‑volume transactions may experience slight latency due to verification protocols.

- Fee Structure: While Gold365 maintains competitive spreads, users should review any ancillary fees, such as storage or withdrawal charges, to avoid surprises.

Conclusion

Gold365 delivers a compelling blend of security, transparency, and convenience for investors seeking digital exposure to gold. Its real‑time pricing, instant settlement, and fully backed physical reserves make it a trustworthy gateway into the world’s most venerable asset class. When paired with platforms like 11xplay pro, investors can craft diversified, resilient portfolios that balance the stability of gold with the growth potential of equities and other instruments. As the financial landscape continues to digitize, embracing such integrated solutions will be essential for anyone aiming to stay ahead in wealth management.